The IRS doesn’t recognize domestic partnerships or civil unions as marriage. You can only file married filing jointly or separate if your marriage was entered into in a state or country where same-sex marriage is legal. Conversely, if you are legally married, you can no longer file as a “single” taxpayer. Learn more here.

If you are considering second parent adoption, you may want to wait to walk down the aisle. The adoption credit can be valuable if you qualify for it, but you cannot avail yourself to this useful tax credit if you are already married to the biological parent of the child you are adopting.

If you recently changed your name as part of your transition or because of marriage, use the name on your social security card on your tax return, even if that is not your preferred or legal name. If you use your new name, you may delay the processing of your return because the IRS uses the social security administration database as a cross reference for taxpayer names and social security numbers.

Generally, cosmetic surgery is not deductible unless it is necessary to ameliorate a deformity from a congenital abnormality, personal injury resulting from an accident, or a disfiguring disease. However, in a 2007 landmark case for transgender rights, the US Tax Court held that sex-reassignment surgery could qualify as a deductible medical expense. Other deductible that are recognized treatment for gender dysphoria include hormone therapy and, in certain cases, breast augmentation.

The tax code allows a taxpayer to deduct unreimbursed expenses for medical care of themselves, their spouse or their dependents. However, a surrogate mother and her unborn child are not deductible. This is especially frustrating because the costs associated with surrogacy are significant. Unfortunately, the IRS has documented their position on this issue and is not likely to change it anytime soon.

Some couples pay more income tax as a married couple than they would have as two single individuals. There is also a “marriage bonus” where some couples pay less in taxes because of marriage. There are many income tax limitations, thresholds and maximum deductibility limits that change when individuals marry. Check out this calculator to see which one applies to you and your partner. Fun fact: the Congressional Budget Office reported same-sex marriage tax filings would likely be revenue neutral, suggesting an even split of revenue generated from couples facing the “marriage penalty” versus those benefiting from a “marriage bonus.” How’s that for marriage equality?

The statute of limitations is still open for tax years 2011 and 2012. If you were legally married during those years and believe you would have paid fewer taxes, there is still time to claim tax refunds. The statute of limitations is generally three years from the date you filed your return or the original due date of the return, whichever is later. If you filed by April 15, 2012 for the 2011 tax year, the statute of limitations will toll on April 15, 2015.

Shocking, we know. Despite the wide array of guidance provided by the IRS many employers are still incorrectly imputing income and taxing health benefits for same sex spouses. After you marry, alert your employer immediately and check your pay stubs regularly to ensure the change has been effectuated. Your employer must stop imputing income in a reasonable time frame after receiving notice of marriage. If they do not, contact human resources. If they are no help, contact an attorney. If you are in a domestic partnership or civil union, your employer is still required to continue imputing income and taxing the health benefits to your partner.

There are several reasons this presumption may cause a larger combined tax bill for families; these include the Alternative Minimum Tax, Child Tax, Earned Income, Education and Dependent Care Credits. When couples prepare their own tax returns or employ separate tax advisors to prepare their tax returns, this issue can be easily overlooked, potentially costing families thousands of tax dollars annually. Learn more here.

Let’s face it, many people can prepare their own returns and many can even use the IRS’ free file web-sites, but it’s not always so easy. If you are legally married and live or work in a state that does not recognize same-sex marriage, you will likely need the help of a certified public accountant to help sort out the correct way to file your state tax returns, and if necessary, file protective refund claims to ensure you can receive any state “marriage bonus” refunds when the state you live or work in eventually recognizes your marriage.

A rainbow sticker with the letters C-P-A on an office door doesn’t make someone a qualified LGBTQ tax or financial advisor. Your advisors should be comfortable with you and you should be comfortable with them. Ask for references of other LGBTQ clients they represent and ask those references what it was like to work with that advisor. Also, consider asking your LGBTQ friends whom they use to prepare their taxes. Whenever possible, and definitely if you own property jointly or co-mingle your finances, you and your partner should use the same advisor. It’s hard for any advisor to do tax planning with only half of the facts!

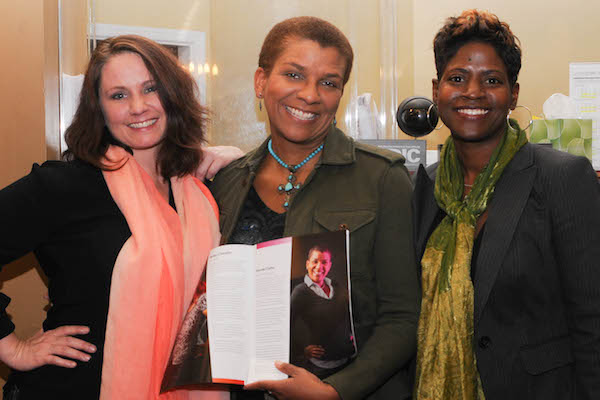

Rosalind W. Sutch, CPA, MT, is a shareholder at Drucker & Scaccetti (D&S), a Philadelphia-based tax advisory firm. Roz leads D&S’s LGBT Tax Consulting & Financial Planning Practice Group and can be reached at rsutch@taxwarriors.com.